The Japanese Mobile Landscape according to App Annie

This is a summation of a report released earlier today by App Analytics firm App Annie. For the first time in history of the app industry, the United States is not the leading revenue generating country on Google Play. As of last October is was surpassed by Japan. A country whose gone through tremendous change in their ‘app economy’ and looks to be continue growing as a global app powerhouse.

Once dominated by feature phones, Japan’s mobile culture is shifting towards smartphones. At the end of 2011, only 23% of handsets being used in Japan were smartphones. Today, Japan’s mobile environment is rapidly evolving. Industry experts believe that feature phones will be extinct in Japan in the next five years as consumers switch over to iPhones and Android smartphones.

The iOS app store ecosystem is disrupting the Japanese mobile industry by removing the ability for carriers to control content which weakens their ability to influence phone manufacturers. Since they cannot control the manufacture and sale of the iPhone, nor can they control the iTunes store (DoCoMo does not partner with Apple).

For new devices, they focus on Android so they can still influence domestic phone manufacturers while keeping the ability to distribute content through their own platforms. On the other hand, with KDDI and Softbank as the 2nd and 3rd largest carriers offering the iPhone, meaning they are happy for Japanese consumers to consume content through the iOS app store instead of the carrier platforms.

As app stores quickly transform the way consumers access content, carriers are deprived of a once key revenue stream. Which means carriers must now rely more on device sales to boost revenues.

Apple and Google are also changing the balance of power as content control moves into the hands of app stores. The fight for content control will continue to define Japan’s app industry and it will certainly be interesting to see how DoCoMo’s Android phone strategy will play out in the coming years.

To continue to maintain control over its own content, DoCoMo launched two new services specifically aimed for smartphones dubbed “dmenu,” a portal for accessing internet-based content, and “dmarket,” Docomo’s own internet market offering videos, music, books, and apps.

DoCoMo is betting that carrier control of devices and content is the key to winning Japanese consumers. As carriers make their bets on content distribution, lets take a deeper look at the rise of the app stores in Japan.

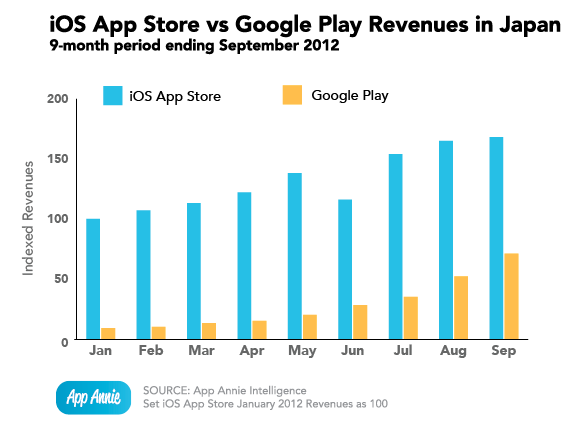

Despite 2/3rds of the Japanese smartphone population on Android and only 1/3rd on iPhone, iOS revenue in Japan still exceeds that of Google Play. For how much longer? Who knows. Google Play is quickly closing the gap as seen in the chart below.

Needless to say, the growing numberof opportunities for Google Play apps to monetize will further incentivize development for its platform.

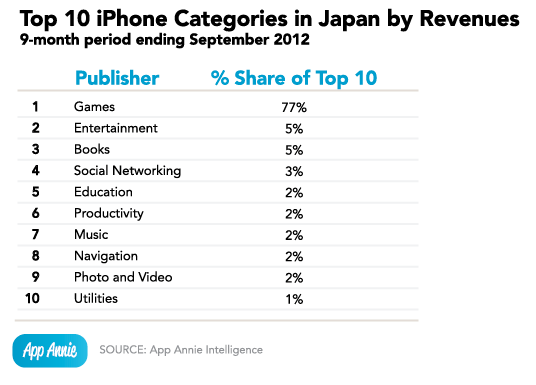

Gaming Companies define the Japanese App Economy. As seen in the chart below, we find that eighteen of the top 20 publishers are gaming companies.

It’s clear that Western developers looking to penetrate the games market in Japan are facing overwhelming competition and additionally have cultural barriers, foreign brands have to compete with a market full of established local players with formidable resources. Notice, not a single gaming heavyweights ( Electronic Arts, Zynga, or Rovio) appear on the list, despite having the resources to build a stronger Japanese presence.

Overwhelming market entrenchment makes it nearly impossible for Western companies to enter the lucrative Japanese gaming market. Western companies that look to gain a foothold in Japan must be ready to invest or have a breakout hit.

Alternatively, foreign publishers could partner with domestic social game platforms like GREE, Mobage (DeNA) and LINE which can give developers access to millions of users. These social game platforms hold tremendous power in Japan, as they foster distribution through friend invites and gamer communities. Electronic Arts partnered with gumi and GREE to develop and distribute their hit game FIFA World Class Soccer. These partnerships drastically expanded EA’s brand’s presence and discoverability in Japan.

Japan is a gaming nation with a growing appetite for social apps; the confluence of both may reshape the industry. As seen in the chart below over the 9 month period ending in September 2012, the games category in the Japanese iOS store represented about 77% of total revenues across all categories. Interestingly the games category in the US iOS store represented only 59% of the total revenues in the same time period.

Social Networking in Japan is also experiencing transformative growth

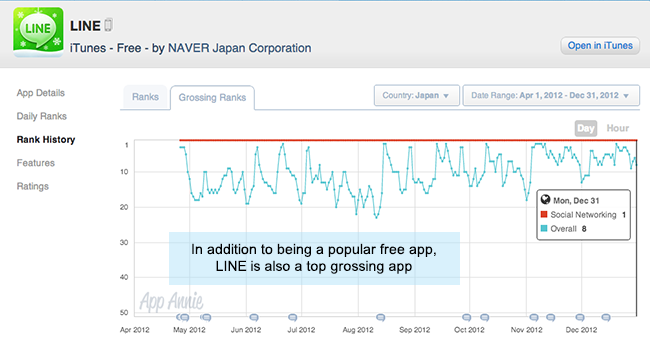

Social networking revenues grew an astounding 383% on iOS when comparing January 2012 against September 2012. In September, LINE continued to have downloads pour in far surpassing both Facebook and Twitter.

Among Headlines in Japan, two are most norotious.

The growth attributed to the social networking category is almost entirely due to LINE by NHN. Launching in June of 2011, the app has amassed over 100 million users worldwide and has ranked #1 in the free iOS app category in over 32 countries. LINE’s dominance in the social networking category makes it a launchpad for social games distribution, moving it into the market territory of GREE, Mobage, and Mixi. The launch of puzzle game LINE POP attained 3 million downloads in just 24 hours after its release and racked up 10 million downloads in 12 days. LINE Birzzle has attained 10 million downloads 97 days after release.

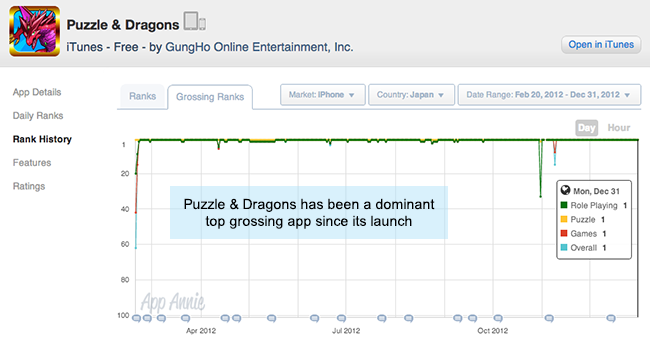

Puzzle & Dragons is notable because it does not rely upon a social game network like GREE, Mobage or Mixi for distribution. Despite this, it has maintained the top grossing position on iOS for nine months. The game also stands out because it takes advantage of smartphone capabilities to create gameplay mechanics typically not seen in most Japanese games.

0 Comments

Trackbacks/Pingbacks